Ssdi tax calculator

529 ABLE 529A accounts. Please remember that these calculators are for informational and educational purposes only.

Quick Calculator Social Security Disability Social Security Benefits Financial Calculators

Report the delinquent payer to the credit bureau.

. However some states set the cap at 100 percent of the poverty level 13590 individual. The Social Security Administration SSA uses a weighted formula to calculate benefits for everyone. Services Offered through the Nebraska Child Support Enforcement Department.

Using this calculator it is possible to estimate net Social Security benefits ie estimated lifetime benefits minus estimated lifetime FICA taxes paid for different types of recipients. If you receive other disability benefits such as Workers Compensation your benefits may be recalculated or reduced. Learn about other Medicare supplement options.

Tax credits for those with disabilities include the. You can apply 2 ways. Amount of Annual.

Social security benefits tax calculator is in a way concrete answer to often asked question Are social security benefits taxableWell social security benefits are taxable to some people and totally tax-free for others as the taxation depends on the computation of total income and other phaseout values which are again dependent on your tax filing status. 1 online tax filing solution for self-employed. Dont think that the child tax credit payments going out in just over two weeks are all the IRS is focused on.

SSDI can also end if while still meeting the medical criteria for disability you are able to work and your income exceeds a limit known as substantial gainful activity SGA. Unlike a tax deduction which only reduces your taxable income a tax credit reduces the amount of tax you have to pay. Also some states provide their own supplement to SSI benefits but no states do so for SSDI benefits.

New Jersey Voter Records 2007-2017 New York State Voter Records 2002-2021 New York Naturalization Records New York State Incarceration Records New York City Tax Photos 1940 1985 New York City Block and Lot Numbers New York City Birth Records 1846-1909 fs New York City Birth Records 1879-1909 igg New York City Birth Records 1878-1909 anc New. You can make the calculations on the IRS Form 1040 tax return or you can use Social Securitys tax calculator. En español Americans started seeing the third round of stimulus payments in their bank accounts on March 12.

The SSDI index looks at average wage indexes and applies them to a beneficiarys average current earnings. Regardless of your age when you start collecting SSDI you receive what you would get if you claimed benefits at full retirement age FRA the age at which you are entitled to 100 percent of the benefit calculated from your average monthly earnings. Intercept state and federal tax refunds.

Similar to a 529 college savings plan 529 ABLE accounts are savings accounts administered by the statesMoney can be withdrawn tax-free when the funds are used to pay for qualified disability expenses. The amount you get from SSDI will be based on how long you worked and how much Social Security tax also called FICA was taken from your pay. People can expect to.

If you qualify for services with the Nebraska Child Support Enforcement CSE Department you can receive the benefit of the following services. You may be able to get Medicaid coverage while you wait. The contribution limit for 2022 is 16000 the amount of the annual gift tax exclusion and many states have total contribution limits that exceed 300000.

Having a low income or financial needs do not affect whether you can get SSDI. The tax agency continues to send weekly batches of the third stimulus checks with. As of May 26 the IRS says it has sent 167 million stimulus payments worth about 391 billion.

Many cases end up being approved after an appeal. For example a 1000 credit reduces the tax you owe by 1000. Claiming the credit can reduce the tax you owe and may also give you a larger refund.

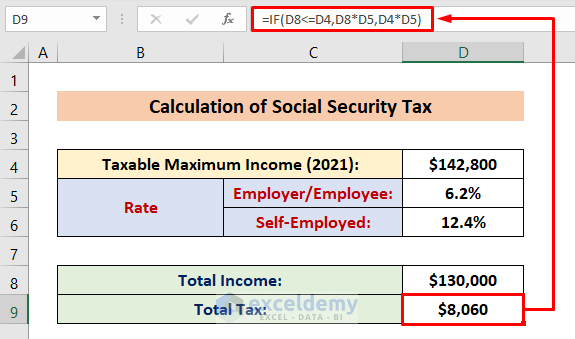

But if you do this youll lose any premium tax credits and other savings for your Marketplace plan. In 2011 and 2012 the OASDI tax rate on workers was set temporarily to 42. The Social Security Administration SSA which is the federal organization in charge of SS levies a 124 tax on earnings which is usually split in half between employee and employer self-employed taxpayers will pay the full amount in the form of a self-employment tax.

If their disability is their only source of income an individual would earn 14808 per year in federal SSDI benefits. If you get SSDI benefits and are in a 24-month waiting period before getting Medicare. What is your filing status.

In 2022 the limit is 1350 per month or 2260 if you are blind. The calculator below will estimate your monthly child support payment based on Louisianas child support guidelines. Child and dependent care credit.

Try our calculator to get an estimate of how much money your family could receive from the Child Tax Credit. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. The YTIOnline SSI Benefits Calculator shows how your benefits may change if.

Locating Parents If you are unable to find a non-custodial parent and you are trying to establish a child support order CSE can assist you. To be eligible for continued SSI or SSDI benefits. This may take place based on the SSDI index which is also the same index used to compute all Social Security benefits.

27750 family of four or use other criteria to determine eligibility. By income assignment intercepting state and federal tax refunds and lottery winnings suspending licenses and registration denying passports and requesting a contempt of court charge the SES can penalizeand attempt to. Social Security disability benefits SSDI can be subject to tax but most disability recipients dont end up paying taxes on them because they dont have much other income.

This estimate does not guarantee the amount you will receive for the child tax credit. Self-Employed defined as a return with a Schedule CC-EZ tax form. If you get turned down for SSDI reapply and appeal if necessary.

The Earned Income Tax Credit EITC helps low to moderate-income workers and families get a tax break. Calculations are based on the data entered and figures from the American Rescue Plan Act of 2021 as of March. The Social Security Disability trust fund funds SSDI whereas general tax revenue funds SSI.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. The two programs also differ in their funding source. On average SSDI recipients receive between 800 to 1800 in monthly payments with an average of 1258 per month but the actual amount varies from case to case.

Credit for the elderly and the disabled and. FRA is 66 and 4 months for people born in 1956 and is gradually rising to 67. Americas 1 tax preparation provider.

According to the SSA in 2019 the average SSDI payment was 1234 per month. Amount of Monthly Income. You may need to file your 2020 tax return this year to get the right stimulus check amount If you need to add a dependent the IRS doesnt know about youll need to file a simple 2020.

In this situation an individual receiving the average SSDI benefit about 1361 a month as of April 2022 and no other income could qualify for Medicaid. The calculator below will estimate your monthly child support payment based on Marylands child support guidelines. Department of Treasury and the IRS are working hard to get relief payments out the door as fast as possible to the American people.

Tax rate is the sum of the OASDI and Medicare rate for employers and workers. SSI provides health coverage through Medicaid while SSDI does so through Medicare. Earned income tax credit.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Social Security How To Boost Your Benefit By 800 In 2022 Social Security Benefits Social Security Disability Social Security

Social Security Benefits Tax Calculator

Easiest 2021 Fica Tax Calculator

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

Resource Taxable Social Security Calculator

Social Security Benefits Tax Calculator

Taxable Social Security Calculator

Quick Calculator Social Security Disability Social Security Benefits Financial Calculators

Taxable Social Security Benefits Calculator Youtube

How To Calculate Social Security Tax In Excel Exceldemy

Calculating Taxable Social Security Taxes On Social Security Benefits Part 2 Of 2 Youtube

Pin On Spreadsheets

This Social Security Planner Page Explains When You May Have To Pay Income Taxes On Your Social Security Benefits Income Tax Income Social Security

Social Security Benefits Tax Calculator

:max_bytes(150000):strip_icc()/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)

Is Social Security Taxable